Special Offers

How To Get Tax Amnes...

How To Get Tax Amnesty for your Client? Basics of Forgiveness of IRS Debt

$149.00

There’s never been a better time to resolve a delinquent tax problem with the IRS. Not so much becau..

How To Get Tax Amnes...

How To Get Tax Amnesty for your Client? Basics of Forgiveness of IRS Debt

$149.00

There’s never been a better time to resolve a delinquent tax problem with the IRS. Not so much becau..

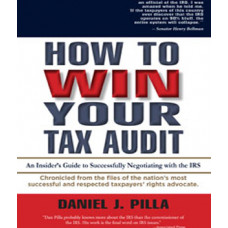

How To Win Your Tax ...

How To Win Your Tax Audit

$37.90

How to Win Your Tax Audit Author By : Daniel J. PillaIRS audits can be unnerving expe..

Inherited IRAs: Unde...

Inherited IRAs: Understand Tax Issues and Planning

$159.00

Inheriting an IRA comes with its own tax nuances not only for individual beneficiaries but also for ..

Inherited IRAs: Unde...

Inherited IRAs: Understand Tax Issues and Planning

$159.00

On July 19, 2024, the IRS issued new regulations clarifying the rules surrounding inherited IRAs, pr..

Inherited IRAs: Unde...

Inherited IRAs: Understand Tax Issues and Planning

$159.00

Inheriting an IRA comes with its own tax nuances not only for individual beneficiaries but also for ..

IRS Collection Proce...

IRS Collection Process: How to Deal with the IRS Collection Division

$149.00

Many practitioners believe IRS collection activities to be random when in fact the process is a very..

IRS Form 1099 Report...

IRS Form 1099 Reporting - MISC Updates for 2020

$149.00

For years, businesses reported payments to contractors in box 7 of the 1099-MISC . Starting in..

IRS Form 1099 Report...

IRS Form 1099 Reporting - MISC Updates for 2020

$149.00

For years, businesses reported payments to contractors in box 7 of the 1099-MISC . Starting in..

IRS Form 709: The Fe...

IRS Form 709: The Federal Gift Tax Return

$149.00

Oft ignored by the unwitting taxpayer and overlooked by the practitioner, gift tax returns are left ..

IRS Form 709: The Fe...

IRS Form 709: The Federal Gift Tax Return

$149.00

Oft ignored by the unwitting taxpayer and overlooked by the practitioner, gift tax returns are left ..

IRS Issues Revised 2...

IRS Issues Revised 2021 Form 941: The Latest Changes for Q2-Q4 2021 that You Need to Know About!

$199.00

IRS Issues Revised 2021 Form 941 With Changes for End of Deferrals, Employer’s Quarterly Federal Tax..

IRS redesigned Form ...

IRS redesigned Form W-4 for 2021: What all you need for Compliance Requirement

$199.00

The Tax Cuts and Jobs Act (TCJA) brought with it many changes. For individuals, some of the changes ..

IRS Releases Final R...

IRS Releases Final RMD Regulations: Understand Tax Issues and Planning

$159.00

On July 18, 2024, IRS issued final regulations to update the required minimum distribution (RMD) rul..

IRS Releases New 202...

IRS Releases New 2020 Form 941 Accommodates Reporting of COVID-19 Employment Tax Credits

$199.00

New 2020 Form 941 Accommodates Reporting of COVID-19 Employment Tax Credits: Are you ready to ..